DOSSIER

- Welcome

Accueil - Nieuws

Nouvelles- 07/01 World’s Oldest Shipwreck Is at Dokos Island, Greece

- 09/01 Port Oostende Fights to Preserve Critical RoRo Shipping Route.

- 11/01 LNG bunkering poised for a bright future

- 14/01 Russische driemaster Shtandart nergens welkom, kapitein wacht met smart op coulance van Brussel

- 16/01 Russia resells more gas in Europe after cutting off Austria, sources, data show

- 21/01 EU Closes in on More Tanker Sanctions to Enforce Russian Oil Price Cap

- 23/01 Black swan events keep container lines shipshape

- 25/01 As war blocks Russia, China boxes take Middle Corridor

- 28/01 Novatek Still Plans LNG Expansion Despite Sanctions

- 30/01 Global shipping costs to remain high amid tariff threats, Red Sea challenges

- 01/02 Russian project cargo sector growing despite sanctions

- 03/02 Optimising port arrivals could cut emissions by 25 per cent

- 05/02 New BIMCO Clause on FuelEU Maritime

- 07/02 Houthi attack hits container ship in Arabian Sea

- Kalender Calendrier

- BML Nieuws

LMB Nouvelles - Historiek

Historique- 18/11 De schipbreuk van de kotter Princess of Wales en de schoener l'Aventure (I)

- 25/11 De schipbreuk van de kotter Princess of Wales en de schoener l'Aventure (II)

- 29/12 De schipbreuk van de kotter Princess of Wales en de schoener l'Aventure (III)

- 05/01 De schipbreuk van de kotter Princess of Wales en de schoener l'Aventure (IV)

- 12/01 De schipbreuk van de kotter Princess of Wales en de schoener l'Aventure (V)

- 19/01 De schipbreuk van de kotter Princess of Wales en de schoener l'Aventure (VI)

- 26/01 Gamming Chairs and Gimballed Beds: Women on board 19th-century Ships

- 02/02 De Belgische vissers tijdens de tweede wereldoorlog

- 09/02 Dans l'enfer des Chinchas (I)

- Dossier

Dossier

- 08/01 How SECNAV’s claims about S. Korean, Japanese shipbuilders do and do not line up

- 10/01 Ocean container shipping market reaches a tipping point

- 13/01 La révolution culturelle chez Maersk, les revirements et autres effets de panique

- 15/01 Sharing tussles over major sea route worry exporters

- 17/01 Somali piracy: It's more sophisticated than you thought

- 20/01 Containership and port operators face a host of issues as peak season arrives

- 22/01 Pioneering Spirit picks up the reins for GTA deepwater pipelay

- 24/01 'Dark fleet' of oil tankers risk more maritime disasters in Asia

- 27/01 There’s no one on that ship!

- 29/01 Results from US probe into Chinese shipbuilding expected soon

- 31/01 Bright oil future bolsters bonds for Suriname as TotalEnergies develops highly-anticipated deepwater drilling sites

- 04/02 Applying Wind Assisted Propulsion to ships report (I)

- 06/02 Applying Wind Assisted Propulsion to ships report (II)

- 08/02 Decarbonizing The Global Container Fleet With HeatPower

- Raad

Comité - Verenigingen

Associations - Contacten

Contacts - Links

Liens - Boeken

Livres - Archives

Archieven- Archieven 1 - Archives 1

- Archieven 2 - Archives 2

- Archieven 3 - Archives 3

- Archieven 4 - Archives 4

- Archieven 5 - Archives 5

- Archieven 6 - Archives 6

- Archieven 7 - Archives 7

- Archieven 8 - Archives 8

- Archieven 9 - Archives 9

- Archieven 10 - Archives 10

- Archieven 11 - Archives 11

- Archieven 12 - Archives 12

- Archieven 13 - Archives 13

- Archieven 14 - Archives 14

- Archieven 15 - Archives 15

- Archieven 16 - Archives 16

- Archieven 17 - Archives 17

- Archives 18 - Archieven 18

- Archieven 19 - Archives 19

- Photos

Foto's

Applying Wind Assisted Propulsion to ships report (I)

Introduction

Energy efficiency has always been a competitive advantage in a market where fuel represents a major operating expense. With the emergence of maritime decarbonisation ambitions, it has become an imperative.

Energy efficiency has always been a competitive advantage in a market where fuel represents a major operating expense. With the emergence of maritime decarbonisation ambitions, it has become an imperative.

Optimising the fuel efficiency of ships will prolong compliance as new legislation demands stepped improvements in emissions, fuel consumption and energy intensity, minimise carbon costs as market-based measures emerge and – for vessel operators aiming for close to or full decarbonisation – significantly reduce spend on costly zero- or near-zero emission fuels.

A range of energy efficiency technologies (EETs) are now being deployed by operators to stack incremental savings in engine power, propulsion and hull resistance. But the slow uptake of many such technologies speaks to the challenges in adopting them. EETs are at various stages of technology readiness and, as a result, many operators, designers and shipbuilders are not familiar with using or installing them.

What limited service experience there is shows widely varying performance, often at odds with optimistic claims made before installation.

With no standardised method of verifying savings for some technologies, clarity on the true impact on operating costs can be elusive. So too does full understanding of the operational constraints entailed, with some solutions potentially affecting factors including vessel speed, cargo capacity and port access.

Introducing such measures as part of a newbuilding project, with a holistic consideration of energy use and operational implications from the initial design stage, is challenging enough. Adapting and attaching them to existing ships can be even more so, given the differing installation requirements and the added complexity of calculating potential efficiency gains and return on investment for mid-life vessels.

The new LR Energy Efficiency Retrofit Report series aims to support industry uptake of EET's on existing ships. This report, focused on wind-assisted propulsion systems (WAPS), examines current deployment and readiness of the main technology candidates, as well as highlighting drivers and potential challenges to future uptake – including supply and installation capacity, safety and regulatory frameworks and operational considerations.

This publication follows the release of the initial Engine Retrofit Report last year, outlining the market and technology status of engine conversions for alternative zero- or near-zero emission fuels. Combined with the Fuel for Thought series exploring new fuels, and future instalments of this report focused on other EET categories, the suite of documents from LR represents a comprehensive insight into the challenges of adapting existing vessels for operation in the era of decarbonisation.

A return to wind

Calling wind propulsion a ‘new’ technology may be something of a mis-representation for shipping. But while they harness the same free, widely available energy resource, the solutions using wind to support propulsion on today’s vessels bear little resemblance to those of bygone eras.

Even where similar terms like sails are used, the materials, structures and methods of control for WAPS technologies are more akin to those used on space shuttles than schooners.

Understanding how WAPS technologies can be integrated onto modern vessels requires a similar leap forward if maritime operators are to take advantage of their potential to support decarbonisation. The analysis in this report suggests that WAPS technologies are poised for a dramatic increase in uptake as ship-owners seek solutions that can both contribute to emissions reduction and partially offset the costs of other decarbonisation measures. But there are several obstacles still to be overcome if that widespread adoption is to be realized.

The four WAPS technologies most commonly deployed today - Flettner rotors, rigid sails, suction wings and kites – each come with their own challenges, operating constraints and installation considerations, alongside savings that can vary significantly depending on how they are deployed. Other technologies, including soft sails and hybrid versions of existing solutions, are also emerging as the sector evolves. These have not been considered here as their current base of installations and orders on merchant vessels is limited.

Across all technologies, there are supply issues to be addressed in light of growing demand that is expected to accelerate even further as decarbonisation targets tighten and the cost of operating on conventional fuel increased.

Supply chain evolution will need to be supplemented by increased installation capacity and capability, with only around 16 yards to date having carried out WAPS retrofits.

In the face of these uncertainties, choosing whether to deploy WAPS, which technology to select and how to plan installation is a daunting task. LR has been helping shipowners make these choices since the very first retrofit projects. And it has been deploying that experience to the benefit of the industry at large, for example developing an online, open-access savings calculator for those considering Flettner Rotors.

LR has delivered multifaceted support for this emerging sector. Alongside the core role of ensuring ships are built to class and fulfil statutory requirements, those services include:

- Feasibility: Techno-economic feasibility studies; Independent third-party performance studies; System impact studies; Climate resilience analysis; Navigation and route studies; Port and commercial compatibility; Scoping and tendering support.

- Engineering: Engineering and conceptual designs; Structural FEA analysis and CFD modelling.

- In-service: Short- and long-term performance verification; Port emission inventories.

In addition to these services, LR participates in industry-wide knowledge building as a member of the International Wind Ship Association (IWSA), recently participating in the first Wind Propulsion Technologies Roundtable held by IMO Low Carbon Global Industry Alliance.

Several of the learnings gained through this deep experience are illustrated in the recently published LR Guidance Notes on wind-assisted propulsion systems. This report supplements that by examining the market, drivers and challenges specific to retrofitting WAPS technologies on existing vessels. As always, LR does not favour any specific technology, preferring to present a balanced case that recognises the advantages each may have in different applications.

While some stakeholders advocate a return to full wind power for vessels, in LR’s opinion that option remains limited to some very specific trades and vessel types. But wind as a supplementary propulsion provider is eminently feasible across a wide range of vessel types - if the challenges noted in this report can be addressed.

The role of LR is to support technology providers, ship-owners and shipyards in managing those challenges, identifying the ways in which shipping could maximise its use of this unlimited, emission-free energy source.

Foreword

The world of shipping is moving inextricably forwards with an energy transition that not only rivals but surpasses any such transition our industry has achieved before. The move from human power to wind, from wind to coal and steam and then onto oil were all tremendous, fundamental changes but they were undertaken with smaller ships, a less numerous fleet over a longer period than we have today, and we were moving towards an abundant and cheap energy source.

Now we face the same challenge but with few of those advantages, except when it comes to revisiting wind energy and once again using that commercially to move the fleet. But rather than ‘rewinding’, we are ‘re-winding’ using new and improved technologies to harness the energy, enhanced materials that they are made from and the know how to optimise the use of this energy source. These systems are being installed across a spectrum from ones that generate a limited amount of power referred to as ‘wind-assist’ to more powerful systems installed on optimised new builds referred to by the term ‘primary wind’ that can provide most or even all of the propulsive energy required.

The potential of this field to transform how ships are propelled drew me to this sector twenty years ago. The thought of using a zero-emissions, zero-impact energy source that is abundant, delivered to the point of use, globally available, free of charge and accessible to all was a powerful brew. For the past decade, I have headed up the global association that represents wind propulsion technologies, and that brew continues to be an inspirational one.

However a critical part of the challenge is how to harness that energy and ensure those systems and solutions are safely installed, well operated and deployed countless times in some of the most challenging conditions that machinery can operate in. And not for months or years, but for decades. It is the answers to these questions that reports and guidelines such as this deliver to the industry, building on five thousand years of collective wind ship knowledge and decades of modern shipping knowhow.

Our industry is far from a unitary body. Different segments do different jobs with different vessels, They use varied technologies and various fuels in variable configurations, operating in alternating environments, alternate crews and owned by rotating companies. However one of the things that unites us is that these vessels float. And if they float, they can be moved by the wind.

1 Current market

Global fleet uptake

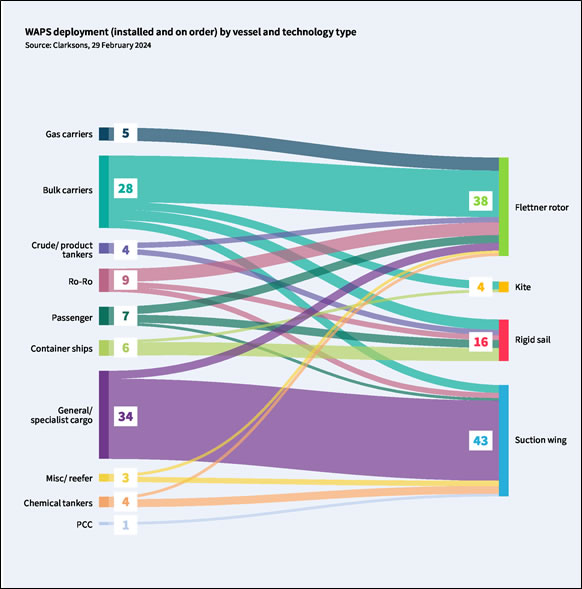

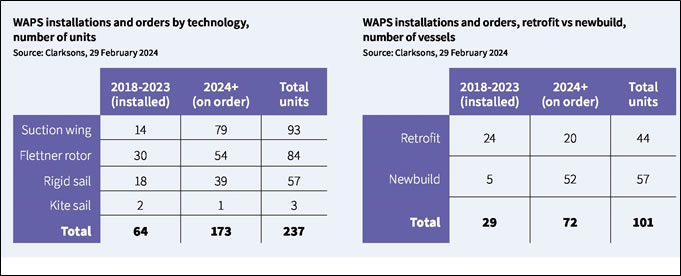

As of the end of February 2024, Clarksons data - drawn from a fleet of more than 108,000 existing and more than 6,000 on-order vessels - identify 101 ships on which WAPS systems have been or are planned to be installed since 2018. The orderbook for 2024 and beyond highlights the accelerating uptake of WAPS systems, with 72 orders compared to the 29 vessels on which WAPS systems were installed between 2018 and 2023.

Looking at the difference between installed and on-order projects, it is worth noting that Flettner rotors are the WAPS technology with the largest installed base. As orders stand, they may be overtaken by suction wings over the coming years, although an element of uncertainty remains based on current data; based on LR analysis of orders claimed by manufacturers, several suction wing projects included in the Clarksons analysis are not at firm order stage, possibly overstating the project pipeline. Kite sails remain of niche interest, both in the number of installations and orders.

Vessel segments

Bulk carriers are the largest single segment to install wind propulsion to date (10 vessels) and will remain so based on existing orders (18 vessels). Tankers, passengers and Ro-Ro vessels all have orderbooks similar to the number of installations already performed. Orders for the first WAPS installations on gas carriers (both LNG and LPG), container ships and car carriers reflect the increasing and broadening uptake of wind power.

The chart highlights WAPS technology uptake by vessel sector. The strong future uptake of suction wings based on interest from beyond the core merchant segments of bulk, tanker and container vessels is noteworthy, with 27 forthcoming installations in the general/specialised cargo segment. Meanwhile, Flettner rotor orders are primarily destined for the bulk carrier segment, with gas carriers emerging as new user based on five planned installations.

Bulk carriers are the most diversified WAPS users to date, with installation or orders for all technologies, while Flettner rotors and suction wings are both the widest used technologies overall and the most diversely applied cross vessel segments.

Technologies and suppliers

The relatively small number of wind installations is accounted for by around 16 technology companies, including shipyards as well as WAPS specialists. There may be more suppliers, with 45 systems on order not linked to named suppliers, and more are certainly on the way; the International Wind Ship Association (IWSA) identifies more than ten companies with technologies at the pre-market stage and at least 20 more at the research and development stage. At present, suppliers deliver four main system types (see Technology section for details). Note that unlike the other charts in this chapter, the table below shows numbers for units, rather than vessels. Each vessel will have one or more units installed.

A noteworthy trend hidden in the aggregation of data is that the number of devices per ship has been increasing since 2022, as WAPS installations move past pilot testing and demonstration purposes. Taking Flettner rotors as an example, in 2018, two out of four vessel installations deployed just one unit each. In 2023, all four vessels were fitted with more than one unit. This trend illustrates the advancing market acceptance and lower perceived risk associated with wind propulsion.

Newbuild vs retrofit

To date, the vast majority of WAPS installations (83%) have been applied to existing vessels, with just five newbuilds including wind propulsion devices from the initial design stage. But as acceptance of the technology is increasing, wind systems are being applied to new vessels more frequently, with 72% of planned installations to take place at shipbuilders rather than conversion yards. The trend is consistent across the different wind technologies.

The scaling up of newbuild wind installations is expected to continue at the same time as a sizeable retrofit market emerges. While the proportion of newbuilds deploying wind propulsion will continue to increase, there is a large fleet of existing vessels that are likely to consider WAPS systems to meet impending decarbonisation requirements and reduce carbon cost exposure (see Drivers section).

Observations

Current market data highlight three key considerations for the uptake of wind-assisted propulsion, which will be explored in greater detail throughout this report:

Operator experience: WAPS systems are installed on less than 0.03% of the global fleet, with planned installations taking that to just under 0.1%. Stretched across multiple technology types and several suppliers, that equates to very limited industry familiarity with any particular WAPS system. This low level of experience is a result of the novel technologies being deployed, their low technology maturity relative to other EET's and perhaps the limited safety and operational guidance from regulators around WAPS systems.

Scaling supply: For technology suppliers to meet existing orders would entail them delivering around 2.5 times the number of units they have installed in the past five years. To achieve uptake on around 15% of the global fleet would require a 75-fold increase on that level, requiring a dramatic increase in production capacity.

Installation capability: With just five newbuild WAPS vessels built yet more than 50 on order, shipyards will need to rapidly scale up competencies to meet demand – even more so if ambitious forecasts of uptake are accurate (see Market Forecast). Although more retrofit experience has been gained so far, it remains limited in absolute terms and conversion yards will also need to ensure they have the skills required in anticipation of strong growth.

2 Cost Drivers

As with all EET's, the key drivers to uptake of WAPS technologies are cost and compliance. These factors are increasingly entwined as the introduction of market-based measures – already in effect on a European level and under development at the International Maritime Organization (IMO) – mean that successful adopters of wind propulsion can benefit not just from fuel cost savings but also from reduced exposure to emissions trading requirements, penalties for exceeding greenhouse gas (GHG) intensity targets and fuel levies. And, in some cases, notably the FuelEU Maritime regulation, deployment of WAPS brings enhanced benefits in the form of dedicated reward factors, granting an outsized offset against ships’ fuel use.

Fuel savings

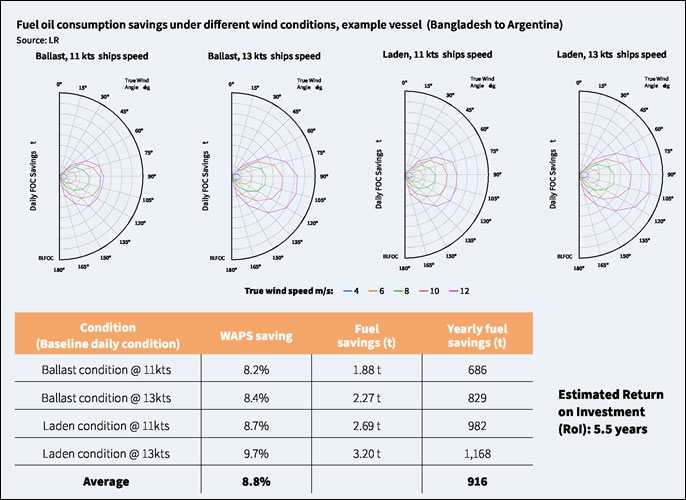

WAPS offers the opportunity for ship operators to reduce the power demanded by engines maintaining the same operational speed, and therefore the associated emissions and fuel cost. Average fuel savings claims made by technology suppliers range from around 5% to greater than 15%. However, calculating, validating and confirming the fuel savings associated with wind propulsion is not straightforward due to the many variables that influence its performance. These include:

- WAPS type, size number of devices and position

- Wind speed and direction

- Ship size (relative to WAPS type and size), speed and direction

- Route, speed and draft

As a result, a thorough understanding of the vessel operating profile as well as the specific WAPS (including its weight and aerodynamic effects) are needed to calculate potential fuel savings. As an example, LR’s online Flettner rotor savings estimator uses inputs based on vessel type and size, route, time of year, loading condition, vessel speed, rotor size and rotor position on deck to deliver a projection of a vessel’s performance, showing power reductions in relation to wind speeds and angles, its monthly fuel reduction potential across the route’s wind conditions, and the yearly average savings under global wind conditions for major trading routes as defined by the IMOii.

For more accurate projections in feasibility studies, to support operators when selecting a technology and supplier, LR generates wind probability matrices to estimate the potential savings of WAPS for different vessel routes under different operative conditions. This enables the tailored estimation of the potential savings and return on investment for the specific application. The example below shows the daily and annual fuel savings for a vessel on all legs (ballast and laden) of a transatlantic route between Bangladesh and Argentina.

Fuel savings verification

Operators should note that there is little standardization of fuel-saving claims or calculations at present, meaning that extra caution should be taken to validate forecasts.

LR has conducted and developed robust methodologies for independent feasibility studies for owners considering WAPS technologies, as well as both short-term (sea-trial) and longterm, in-service validations. It is also participating in the WiSP 3 project run by the Marine Research Institute Netherlands (MARIN), concluding in 2026, which aims to harmonize class rules around WAPS applications, improve predictions and develop standards for determining the performance of wind propulsion systems.

It should also be noted that feasibility studies must go well beyond fuel savings to consider factors including deck space availability, structural integrity, port requirements, client priorities, finance and operational behaviours. These factors are considered in greater detail in Section 5.

Capital expenditure

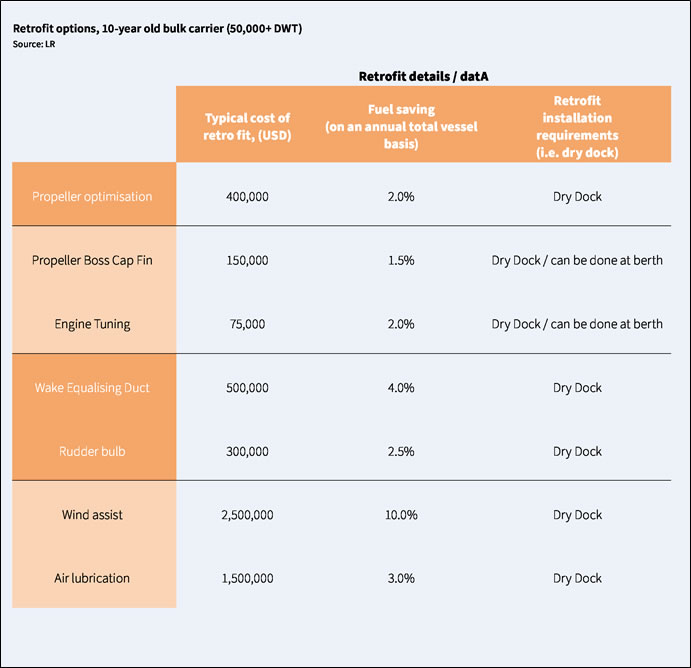

The cost savings associated with WAPS to a ship-owner must be evaluated in comparison to other EETs. As the vessel example here illustrates, wind-assisted propulsion systems can offer the greatest fuel cost reduction potential of any EET – estimated at around 10% as an average across available technologies – but at a substantial cost, estimated at around US$2.5 million.

Operating expense

Alongside capital costs of technology and installation, operators should also consider the operating expense of annual maintenance and repair, energy consumption (where applicable) and crew training.

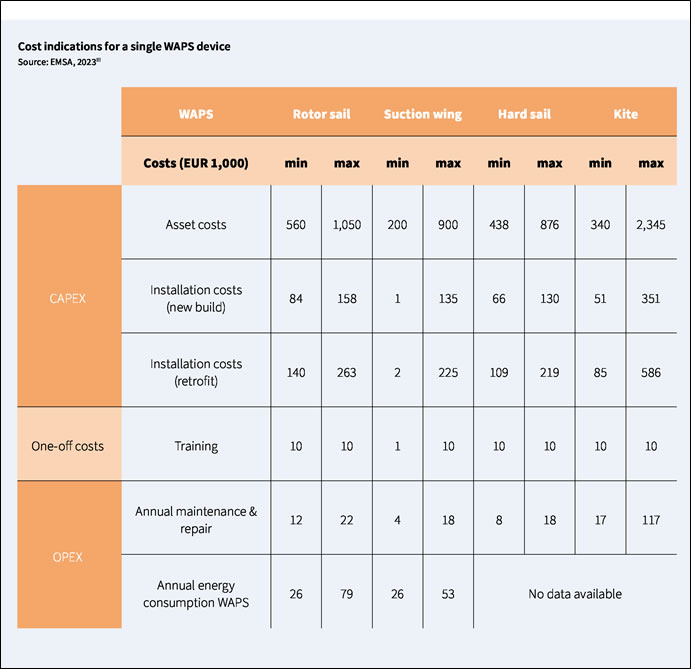

The European Maritime Safety Agency (EMSA) has summarised the per unit (not vessel) costs of WAPS technologies in the table below, differentiating between minimum and maximum sizes. Worth noting are the significantly higher installation costs for retrofit installation compared to newbuild, at around 25% of asset cost compared to around 18%. This reflects the added complexity of applying new structures that have not been designed into initial drawings, on existing vessels. However, yard prices are likely to vary widely depending on slot availability, type of WAPS technology, type of base (e.g., fixed) and shipowner relationships.

3 Compliance drivers

At the current time, the major environmental regulations on which WAPS can have an impact are the EU Fit for 55 legislation, specifically EU ETS and FuelEU Maritime which has direct impacts on any ships calling at an EEA port or anchorage, and the IMO regulations specific to international shipping.

Although not laid out in detail in this report, it should be noted that WAPS will have similar impacts on other national GHG regimes and contribute to reductions in air pollution (and potentially underwater noise) from ships, stipulated by IMO, regional and individual port regulators.

IMO EEXI and EEDI

The formulae for calculating a vessel’s attained Energy Efficiency Design Index (EEDI) and Energy Efficiency Existing Ship Index (EEXI) rating both take into account the energy-saving potential of wind technologies since the adoption of 2021 Guidance on Treatment of Innovative Energy Efficiency Technologies for Calculation and Verification of the Attained EEDI and EEX.

Issues persist around the precise treatment of hybrid and alternative power sources for both measures, as well as the use of specific matrices for wind power. For example, the use of the global wind matrix in the formula can underestimate or overestimate the actual efficiency achieved where winds on the actual routes a vessel plies are more favourable. These issues are being considered in ongoing IMO discussions.

IMO Carbon Intensity Indicator

The IMO Carbon Intensity Indicator (CII) measures operational carbon intensity through fuel consumption reported under the Fuel Oil Data Collection System (DCS), grouping efficiency of operation into discrete bands (A to E) and requiring stepped improvements in the rating. As a WAPS enabled vessel will likely have lower fuel consumption than a conventionally-powered ship at the same speed, effective deployment of wind power will improve CII performance.

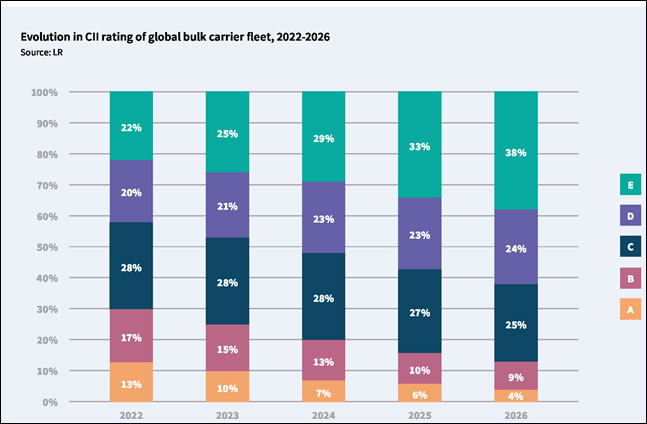

CII could have a dramatic impact on the uptake of EETs particularly for existing vessels aiming to extend compliance – i.e., by prolonging their operation in a better CIII band. Based on an LR analysis of the global bulk carrier fleet, the proportion of vessels attaining CII bands A-C is expected to drop from 58% to 35% between 2022 and 2026 unless significant improvements are made. This equates to around 3,000 vessels that will need to improve efficiency.

Starting from an initial required reduction of 5% in 2023 and adding subsequent 2% annual reductions to 2026, operators are faced with the decision of making minor enhancements at frequent intervals or adopting solutions such as WAPS that can be capable of making multi-year impact from a one-off intervention – and potentially adding five years or more compliant trading for a vessel.

However, the IMO’s forthcoming decision on CII stepped reductions beyond 2026 could have an impact on the uptake of EET. Depending on measures taken to align regulations with I MO’s new ambitions – particularly the target of 5-10% zero- or near-zero emission energy use and the indicative checkpoint of a 20-30% reduction in GHG emissions by 2030 (see below) – it is conceivable that more ship operators might prefer to switch to alternative fuels. Although potentially a more expensive retrofit and fuel cost, these would deliver,in principle, greater long-term emission reduction potential than WAPS.

However, the higher operational costs for alternative fuels will likely make return on investment for WAPS, and all EETs, much more attractive, reducing the barrier to their uptake. A middle way of WAPS/EET with alternative fuels is also foreseeable, with enhanced energy efficiency and lower engine power demand reducing spend on alternative fuels.

IMO revised G H G strategy

Following the adoption of IMO’s revised strategy on the reduction of GHG emissions from ships in 2023, the organisation’s Marine Environment Protection Committee (MEPC) and the subordinate Intersessional Working Group on Reduction of Greenhouse Gas (GHG) Emissions from Ships (ISWG-GHG) are tasked with developing technical and economic measures towards reducing emissions in line with the new ambition, reaching net-zero emissions by or around 2050.

By reducing fuel use, WAPS can contribute to compliance with the IMO revised strategy, notably its ambition that “uptake of zero or near-zero GHG emission technologies, fuels and/or energy sources to represent at least 5%, striving for 10%, of the energy used by international shipping by 2030”v. The extent to which WAPS will be deployed with a view to meeting those longer term targets – including the 2030 and 2040 indicative checkpoints – is less clear. The GHG emission reductions required by those dates, 20-30% and 70-80% respectively based on 2008 levels, would need to combine multiple energy efficiency or zero-emission power solutions alongside wind.

The impact of wind propulsion on the mid-term technical measure (a global-based fuel standard) and economic measure (a pricing mechanism on GHG emissions) will also be driven by its fuel-saving potential, but cannot be assessed while those measures are under development. Wind propulsion has been included in IMO Lifecycle Analysis Guidance of Marine Fuels (LCA Guidelines), which are expected to be used in any new measure, as a zero-emissions pathway. But putting that into effect will require a standardised formula for calculating performance that has yet to be developed. A suggested approach from the International Towing Tank Conference is expected in 2024.

EU Emissions Trading System

Shipping was included in the EU Emissions Trading System (ETS) on 1 January 2024. Tank-to-wake (TtW) CO2 emissions from cargo and passenger ships of 5,000GT and above, reported under the MRV system in 2024, will be subject to the ETS in 2025. For offshore ships and general cargo ships of 400GT to 5000GT, and for offshore ships of 5000GT and above, M RV reporting will be applicable from 2025. A review of the subsequent inclusion of offshore ships of 5,000GT and above is intended by December 2026, for inclusion in the ETS from 2027.

Shipping companies operating those vessels will need to buy and surrender EU Allowances (EUA) to cover half of their GHG (CO2, CH4 and N2O) emissions to and from EEA (EU plus Norwegian and Icelandic) ports, and all emissions for intra-EEA voyages and while at berth at EEA ports. Initially companies will be required to surrender sufficient EUAs to cover 40% of emissions released in 2024, raising to 100% of emissions released in 2026 and subsequent years.

The EU has not considered a further reward for WAPS users in the inclusion of shipping in EU ETS, but it will offer a greater incentive in its forthcoming FuelEU Maritime regulation.

FuelEU Maritime

The FuelEU regulation was passed into law on 25 July 2023 and applies from 1 January 2025, with the exception of articles related to the required monitoring plan, which apply from 31 August 2024.

To incentivise the use of renewable and low-carbon fuels on ships over 5,000GT, FuelEU sets targets that reduce the GHG intensity of energy used on ships, based on 2020 reference levels. The energy use within the scope of FuelEU is similar to the scope of emissions covered under the EU ETS: half of energy use on voyages to and from EEA ports, and all emissions for intra-EEA voyages and while at berth at EEA ports.

The reduction required in the lifecycle GHG intensity of fuels under FuelEU – measured based on reported fuel consumption similar to EU MRV and the emission factors of the fuels used on a well-to-wake basis – will gradually increase over time, starting at a 2% GHG intensity reduction in 2025 to an 80% reduction by 2050. There will be a financial penalty for each quantum of energy used above the reference level.

FuelEU Maritime also grants up to a 5% reduction on the GHG intensity calculation of energy used onboard for those vessels where wind assisted propulsion accounts for 15% or more of the energy used for propulsion. A reward factor is available for vessels with a minimum of 5% of propulsion energy from wind, offering a 1% discount on the GHG intensity calculation. These reward factors are ‘subject to the availability of a verifiable method for monitoring and accounting of wind propulsion energy’ – again highlighting the need for development of standardisation in how energy savings from wind propulsion are quantified.

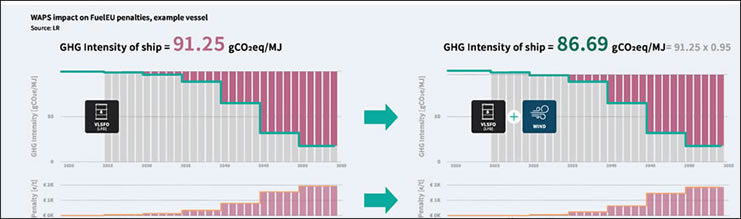

The example below illustrates how a vessel deploying WAPS systems could reduce its FuelEU Maritime penalties – and extend the period until its energy intensity reaches the penalty level. In this case, the vessel achieves a surplus energy intensity until 2030. Under FuelEU rules this surplus can be banked for the following year or used to offset excess energy intensity in other vessels operated in the same pool. After 2030, wind assist continues to pay dividends, saving penalties amounting to more than €100 per tonne of fuel until at least 2035.

To be followed

LMB-BML 2007 Webmaster & designer: Cmdt. André Jehaes - email andre.jehaes@lmb-bml.be