DOSSIER

- Welcome

Accueil - Nieuws

Nouvelles- 04/09 Quand un sous-marin de légende prend la route à contresens

- 06/09 Trois mois après le début de leur croisière mondiale, ils n'ont pas quitté Belfast

- 08/09 Trois mois après le début de leur croisière mondiale, ils n'ont pas quitté Belfast

- 11/09 DEME & Hellenic Cables Wins Contract For World’s First Artificial Energy Island

- 13/09 Crew arrested after yacht fireworks spark Greece blaze

- 15/09 Russia’s Novatek opens season for LNG exports to Asia via Northern Sea Route

- 18/09 MW Fights To Stop Salvage Sale Of Burnt Fremantle Highway Cars

- 20/09 Euronav to change name to CMB.TECH

- 22/09 Houthis Impact

- 25/09 Report: KSOE reveals design of SMR-powered vessel

- 27/09 Seafarers face uphill battle as Happiness Index shows continued decline in Q2 2023

- 29/09 Nuclear propulsion could transform maritime with more reliable, emissions-free and longer-lived ships, LR report says

- Kalender Calendrier

- BML Nieuws

LMB Nouvelles - Historiek

Historique- 02/09 Playing at command midshipmen and quarterdeck officer.

- 09/09 Playing at command midshipmen and quarterdeck officer (II)

- 09/09 Catastrophe maritime à Saint-Pierre de la Martinique

- 16/09 L’Atlantique au temps de la marine à voiles

- 23/09 Shipwreck narratives of the eighteenth and early nineteenth century: indicators of culture and identity

- 30/09 Shipwreck narratives of the eighteenth and early nineteenth century: indicators of culture and identity(II)

- Dossier

Dossier

- 10/09 Does manipulating AIS data help ships avoid Houthi attacks

- 12/09 Why not focus on ship repair before shipbuilding?

- 14/09 Future fuels A to Z – 19 best picks on future marine fuel technology

- 17/09 09 Navigating Through Global Trade’s Troubled Waters

- 19/09 No cargo? No problem! Association of Average Adjusters reviews the ins and outs of Ballast General Average

- 21/09 Tanker prices hit record highs, but sustainability in question

- 24/09 Paving the way for large-scale transportation of liquid hydrogen

- 26/09 UK insurers refuse to pay Nord Stream because blasts were ‘government’ backed

- 28/09 Potential Strait of Hormuz closure threatens 21% of global LNG supply

- Raad

Comité - Verenigingen

Associations - Contacten

Contacts - Links

Liens - Boeken

Livres - Archives

Archieven- Archieven 1 - Archives 1

- Archieven 2 - Archives 2

- Archieven 3 - Archives 3

- Archieven 4 - Archives 4

- Archieven 5 - Archives 5

- Archieven 6 - Archives 6

- Archieven 7 - Archives 7

- Archieven 8 - Archives 8

- Archieven 9 - Archives 9

- Archieven 10 - Archives 10

- Archieven 11 - Archives 11

- Archieven 12 - Archives 12

- Archieven 13 - Archives 13

- Archieven 14 - Archives 14

- Archieven 15 - Archives 15

- Archieven 16 - Archives 16

- Archieven 17 - Archives 17

- Archieves 18 Archieven 18

- Photos

Foto's

Navigating Through Global Trade’s Troubled Waters

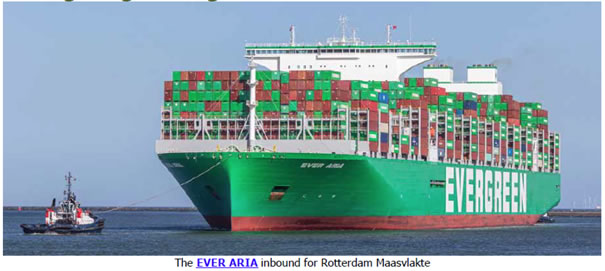

Global trade stands at a critical juncture, buffeted by a series of unprecedented challenges that have tested the resilience of the globalized trade regime. From the disruptive impacts of Donald Trump’s trade wars to the pandemic-induced shocks to global demand, the intricate web of international commerce has encountered obstacle after obstacle. Notably, the maritime sector has not been spared, grappling with incidents like the Ever Given’s grounding in the Suez Canal and the Houthi faction’s efforts to disrupt commercial shipping through strategic maritime chokepoints.As the world enters a year marked by pivotal elections and escalating geopolitical tensions, the discourse around trade is evolving. Concepts of reshoring and friend-shoring are gaining momentum, reflecting a broader shift from cost-centric trade policies to those prioritising risk management and supply chain resilience. This pivot is not just a narrative at the national level but is mirrored in the corporate strategies of multinational entities, signaling a profound transformation in how trade-related risks are navigated. At the heart of this transformation is the realignment of global alliances and trading relationships, influenced by the growing polarity between supranational entities like NATO and the EU, and emerging economic and military partnerships among nations such as Iran, Russia, China, and North Korea. This complex geopolitical landscape is further complicated by nations like India, whose positions fluctuate based on perceived domestic agendas.As we delve deeper into the intricacies of these shifts, it’s essential to understand the drivers at both the national and corporate levels. This introductory exploration sets the stage for a more detailed analysis of how global trade is adapting to an era where risk management supersedes cost efficiency as the guiding principle of trade policy.

The Hurdles in Recent Global Trade History

Trade Wars and Pandemics: A Prelude to Re-shoring and Friend-shoring

The rise of China as a global trade powerhouse since its accession to the World Trade Organization (WTO) marks a pivotal shift in the landscape of international commerce. China’s meteoric rise in exports has not only redefined global supply chains but also underscored the nation’s growing geopolitical influence. This transformation, heralded by the WTO’s multilateral free trade agreements, signified a departure from regionalized trading blocs towards a more interconnected global economy. However, the benefits of this global integration have been accompanied by rising tensions, particularly between China and the United States.

The Sino-US trade dynamic has been fraught with complexities, with the United States grappling with the consequences of a diminishing domestic industrial base against the backdrop of cheap foreign imports. The trade war under Donald Trump’s administration, rooted in longstanding grievances, aimed to address these challenges through tariffs, targeting China’s economic practices, including forced technology transfers and intellectual property issues. This move highlighted a critical reassessment of the multilateral trade system that had facilitated China’s ascent.

The Sino-US trading relationship provides perhaps the most obvious example of an ongoing trade dispute but it is far from the only one. The EU has imposed restrictions on various Chinese goods on the basis of anti-dumping, while negotiations between the block and Mercosur, a trade bloc established in Latin America, on account of concerns over regulatory challenges and competition for domestic industry while the EU and US have their own ongoing trade disputes and punitive tariffs in place and this does not even go to mention Brexit.

Emissions and the Cost of Negative Externalities: Another Hurdle

Parallel to these trade tensions, the maritime industry confronts an increasingly stringent regulatory environment focused on emissions reduction. This sector, vital for global trade, faces a patchwork of regulations that vary significantly across regions. The International Maritime Organization’s (IMO) ambitious targets for reducing GHG emissions signify a global consensus on the need for environmental stewardship. Yet, the actual implementation of these goals reveals a landscape marked by regional divergence.Europe’s leadership through the EU ETS and the FuelEU Maritime initiative illustrates a proactive approach to carbon pricing and greener alternatives. In contrast, other regions exhibit varying levels of commitment, reflecting a broader theme of regulatory divergence. This complex regulatory tapestry not only complicates compliance but also introduces significant costs for shipping companies, influencing trade flows and operational strategies.

Security Threats in Key Maritime Chokepoints: Amplifying Uncertainties

Recent months have witnessed a notable uptick in hostile activities in the Bab-el-Mandeb Strait and the Red Sea, primarily attributed to the Houthi faction based in Yemen. With Iran’s support, the Houthis have intensified their maritime operations, launching targeted attacks on commercial vessels navigating these strategic chokepoints. Such actions have not only exposed critical vulnerabilities within pivotal maritime routes but have also prompted shipowners to alter their courses, specifically avoiding routes that involve cargo destined for, or originating from, Israel. This tactical shift by shipowners reflects growing concerns over seafarer safety and the fundamental right to freedom of navigation. Compounded by pre-existing challenges, such as the reduced water levels in the Panama Canal, these escalations have had a tangible impact on the efficiency and cost-effectiveness of international shipping operations.

In response to the escalating threat posed by the Houthis, an international coalition comprising the United States, the United Kingdom, Canada, Australia, and Bahrain has come together to propose the formation of Operation Prosperity Guardian. This joint maritime task force aims to enhance security for vessels operating in the region. Despite the initiative’s noble intent, the effectiveness of such measures remains uncertain. The Houthis, bolstered by Iran’s substantial backing, have at their disposal a sophisticated arsenal capable of posing significant threats to commercial shipping, challenging the task force’s ability to provide effective protection without further exacerbating regional tensions.

The turmoil in the Bab-el-Mandeb Strait and surrounding areas casts a spotlight on the fragile nature of essential maritime routes integral to the global economy. Approximately 12% of worldwide trade traverses the Suez Canal and its adjacent waterways each year, marking these passages as critical conduits for energy supplies, including oil and LNG, bound for Western Europe and other regions. The Eurasia Group has issued warnings that such disturbances could lead to substantial rerouting of ships, potentially driving up oil benchmarks and exerting upward pressure on global energy prices, thereby contributing to broader inflationary trends.

The actions of the Houthi rebels, underpinned by Iran’s support, resonate beyond maritime security concerns, reflecting the broader geopolitical strife afflicting the Middle East. The establishment of Operation Prosperity Guardian underscores the global community’s apprehension regarding non-state actors’ capacity to disrupt international trade. The nuanced challenge lies in securing these vital waterways while preventing an escalation into more extensive regional conflicts.

The situation unfolding in the Bab-el-Mandeb Strait and the Red Sea serves as a poignant reminder of the intricate interplay between global trade dynamics, regional politics, and security considerations. As nations straddle the delicate balance between safeguarding commercial interests and circumventing widespread military engagements, the international shipping sector finds itself ensnared in a complex geopolitical maelstrom. The enduring resilience of global supply chains and the collective resolve of the international community to confront these challenges head-on will be instrumental in ensuring the seamless continuation of goods and energy supplies across the globe.

Emerging Trends: Re-shoring and Friend-shoring

In the contemporary economic landscape, marked by a confluence of geopolitical tensions, trade wars, and pandemics, the concepts of reshoring and friendshoring have risen to prominence as strategic responses to navigate the uncertainties of global trade. These strategies are gaining traction against a backdrop of disruptions ranging from the US-China trade war, the COVID-19 pandemic’s impact on demand, to regional instabilities affecting critical maritime routes, such as the recent Houthi faction’s activities in the Bab-el-Mandeb Strait.

Re-shoring refers to the practice of bringing manufacturing and services back to the company’s home country. It is a response to the challenges posed by extended supply chains, including the vulnerability to global disruptions, rising transportation costs, and the quest for greater control over production quality and labor standards.

Friend-shoring, on the other hand, involves relocating manufacturing and sourcing to countries that share similar values, political alliances, or trade agreements. This approach aims to mitigate risks by building supply chains within a network of politically and economically stable partners, thus ensuring a more reliable flow of goods and materials.

The shift towards reshoring and friendshoring has profound implications for global trade patterns, potentially leading to a more regionalized economic structure. This transition may foster greater economic independence and security but could also result in higher costs for consumers and strained international trade relations, evidenced by a realignment of trade flows as well as the imposition oof tariffs and other non-tariff measures. Furthermore, these strategies demand a recalibration of trade policies, investment in domestic industries, and enhanced cooperation among allied nations.

Risk Management vs. Cost Effectiveness

The transition from cost-driven policies to risk management strategies in trade policies mirrors the evolving dynamics of the global economy. The traditional model of chasing lower production costs through offshoring has given way to a more holistic understanding of supply chain vulnerabilities. Recent global events, including trade disputes, the pandemic’s widespread impact, and geopolitical tensions, have highlighted the limitations of cost-centric approaches.

Re-shoring and friend-shoring emerge as pragmatic solutions to these challenges, offering a path toward sustainable trade practices that prioritise long-term security and stability over short-term gains. By focusing on risk management, nations and corporations can safeguard against disruptions, enhance supply chain transparency, and foster closer ties with allies and partners sharing mutual economic and security interests.

In the realm of national policies, the growing polarity between global power blocs and the realignment of trading relationships underscore the strategic importance of friend-shoring. Nations are increasingly seeking to bolster economic ties with allies to ensure a steady and secure exchange of goods, technology, and knowledge. This trend is particularly evident in the recalibration of trade dynamics among countries with shared economic, military, or strategic interests, as seen in the collaboration between NATO and EU members and the alignment among states like Iran, Russia, China, and North Korea.In practice, these strategies are likely to be employed on a regional, national and corporate level simultaneously. On a regional and national level, Governments have already began facilitate reshoring efforts through tax incentives, subsidies, and investment in infrastructure that make domestic production more viable and competitive with the US Inflation Reduction Act and elements of the EU’s Green Deal providing an illustration of this. Moreover, by negotiating and enhancing trade agreements with aligned countries, governments can support friendshoring strategies, ensuring that businesses have reliable access to markets that share similar regulatory and economic frameworks. In particular, these negotiations and agreements are already taking shape in key sectors or so called strategic industries. Yet, an element that appears to be lacking somewhat so fa is the will and implementation of support the transition towards reshored and friendshored operations, significant investment in workforce development and re-skilling programs is essential, ensuring that the labor force is equipped to meet the demands of new manufacturing and production paradigms, a crucial element to reverse decades of industrial decline and a transition to a service based economy.

Meanwhile, companies are and should continue to explore diversifying their supply chains across multiple countries, including considering both re-shoring and friend-shoring options, to mitigate risks from any single source. With recent developments in AI and the proliferation of affordable access to advanced models , companies will be able to offset higher labor costs associated with reshoring by investing in automation and advanced manufacturing technologies that enhance efficiency and reduce dependency on human labor. Second, developing strategic partnerships within friend-shoring frameworks can provide stability, ensuring access to critical materials and components while adhering to shared values and standards as well as allowing for a deeper level with partners that conform to similar standards on factors such as intellectual property and environmental, social and governance standards.

Conclusion: The Shifting Paradigms of Global Trade

As global trade navigates through tumultuous waters marked by geopolitical upheavals, regulatory shifts, and the challenges posed by non-state actors, the shipping industry finds itself at the epicenter of these disturbances. The traditional trading regime, underpinned by a web of intricate international relationships, is being tested like never before.From the impacts of trade wars and a rapidly changing regulatory landscape to the threats posed by entities such as the Houthi faction, the maritime sector is experiencing pressures from multiple fronts.

Caught in the Crossfire

Shipping, an inherently international business characterised by complex ownership and operational structures that span across borders and jurisdictions, is particularly vulnerable. This industry, which thrives on the global interconnectedness of economies, is now navigating a period of significant uncertainty. The challenges are multifaceted: dealing with the capricious nature of trade policies, adapting to evolving environmental regulations, and ensuring safety amidst geopolitical tensions. Each of these factors contributes to the unpredictable environment in which shipping operates, underscoring the sector’s pivotal role in the global economy while highlighting its susceptibility to external shocks.

The Changing Nature of Shipping

There are emerging signs that the landscape of international shipping might undergo profound transformations. A potential reversion to utilizing nationally flagged ships could signify a strategic shift towards enhancing sovereignty over maritime assets. This move might be driven by the need for naval protection, assurance against sanctions violations, and adherence to increasingly stringent regulatory standards concerning labor practices, environmental impact, and the ethical sourcing of commodities. The flag of a vessel could become a critical determinant of its operational freedom and market access, reflecting a broader trend towards nationalization and protectionism within the maritime sector.

Regulatory Divergence and Geopolitical Fracturing

The shipping industry is grappling with divergent regulatory regimes that extend beyond emissions to encompass labor practices and the sourcing of non-exploitative commodities. Western measures aimed at preventing child labor, human slavery (e.g., in cobalt mining), and ensuring supply chain transparency (e.g., scope 3 emissions) are becoming more prevalent and stringent. This regulatory divergence, combined with a fracturing geopolitical landscape, signals a potential reconfiguration of global shipping practices.The emphasis on risk management, propelled by disparate regulatory landscapes and the complex web of international politics, may herald a significant shift in how global shipping operates. As nations and corporations strive to mitigate risks and ensure compliance with an expanding array of regulations, the maritime sector could witness a strategic realignment. This reorientation, while aimed at safeguarding interests and maintaining operational integrity, may lead to a reevaluation of the principles that have traditionally governed international shipping.In essence, the shipping industry is at a crossroads, facing the dual challenges of adapting to a rapidly evolving global context while maintaining the fluidity and efficiency that global trade demands. The convergence of regulatory pressures, geopolitical shifts, and economic imperatives may indeed reshape the maritime landscape, compelling a rethinking of strategies and alliances. As the world moves towards a future marked by greater scrutiny and accountability, the shipping industry’s ability to navigate these complexities will be crucial in determining its trajectory in the post-globalization era.

Source: GeoTradeWaves

LMB-BML 2007 Webmaster & designer: Cmdt. André Jehaes - email andre.jehaes@lmb-bml.be